January 2024 – Stock investment using only Canadian ETFs 2

- [December 2023] Stock investment using only Canadian ETFs

- January 2024 – Stock investment using only Canadian ETFs 2

hello. This is Miki’ Honey, MikiHani

Today I would like to share what I found and corrected a mistake in my account.

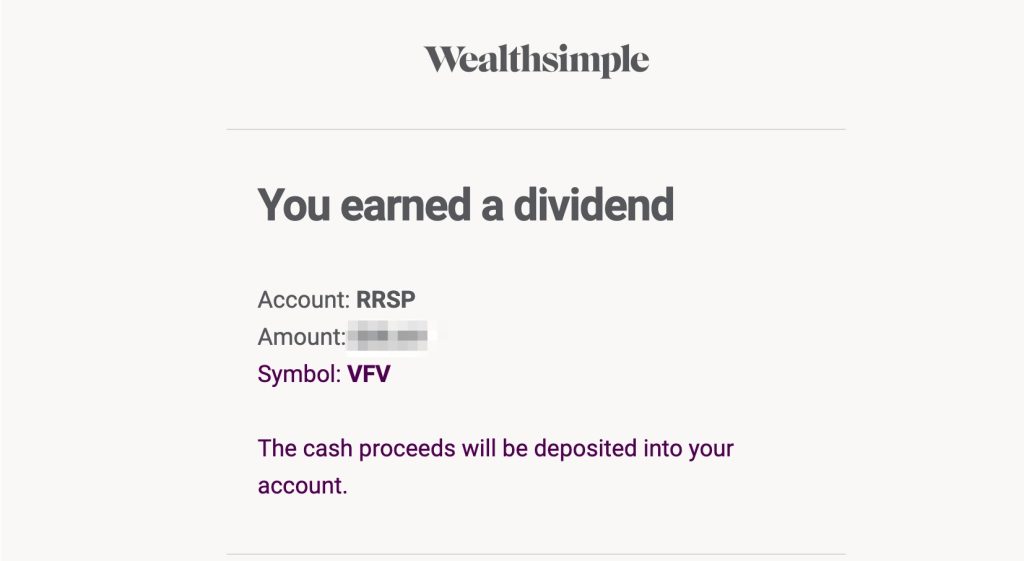

Recently, I received an email from Wealthsimple saying that Dividend has been added to the ETF I own.

So, I checked the divide of the ETFs I had.

however!!! ah… I was making this beginner mistake.

First of all, I am investing in stocks with two accounts, RRSP and TFSA, each of which holds the following.

| RRSP | TFSA |

| VFV (S&P 500 ETF) HXQ (Nasdaq 100 ETF) HSAV (HISA ETF) VLB (Canadian Long-Term Bond ETF) | HSAV (HISA ETF) VFV (S&P 500 ETF) |

Do you see anything wrong?

yes. You shouldn’t have a VFV in your TFSA. Because VFV is a US stock, the US government imposes a 15% tax upon receiving Dividend. However, there is no charge for RRSP accounts.

There may be tax implications if you allocate an outsized proportion of assets to foreign-dividend-paying stocks inside a TFSA, as this dividend income may be subject to withholding taxes by foreign governments.

So, I sold all of my VFV in my TFSA, bought HSAV for that amount, and bought the same amount of VFV in my RRSP. The cost was covered by selling the HSAV of the RRSP.

In conclusion, my total portfolio remains the same, but next time I do not have to pay taxes on the 15% of the Dividend from VFV.

Fortunately, Wealthsimple sent me an email saying that Dividend had been released, so I was able to confirm it.

I didn’t receive an email like this when I used TD Direct Investing before, but I think Wealthsimple is definitely easier to use. Of course, the fact that there are no fees is a huge advantage. There were 5 trades while adjusting my portfolio today, but the transaction fee was $0!

Auto Dividend Reinvestments

Additionally, Wealthsimple has a feature called Auto Dividend Reinvestments. If you turn this feature on, it automatically reinvests in the same stock when it receives a divide.

The reason this is possible is because Wealthsimple supports Fractional Buys. You can buy only 0.4 shares of a stock that costs $100 per share by paying $40.

So, even if you receive a Dividend of $130.15, an additional investment is made automatically by making a Fractional Buy equal to exactly that amount.

This automatic investment function is quite convenient. Even if you only own 3 or 4 stocks, you can receive Dividend quite a few times a year, but going in and buying stocks again on a regular basis is a bit of a hassle. If you turn on the Auto Dividend Reinvestments feature, you will avoid the hassle of checking and purchasing stocks every time.

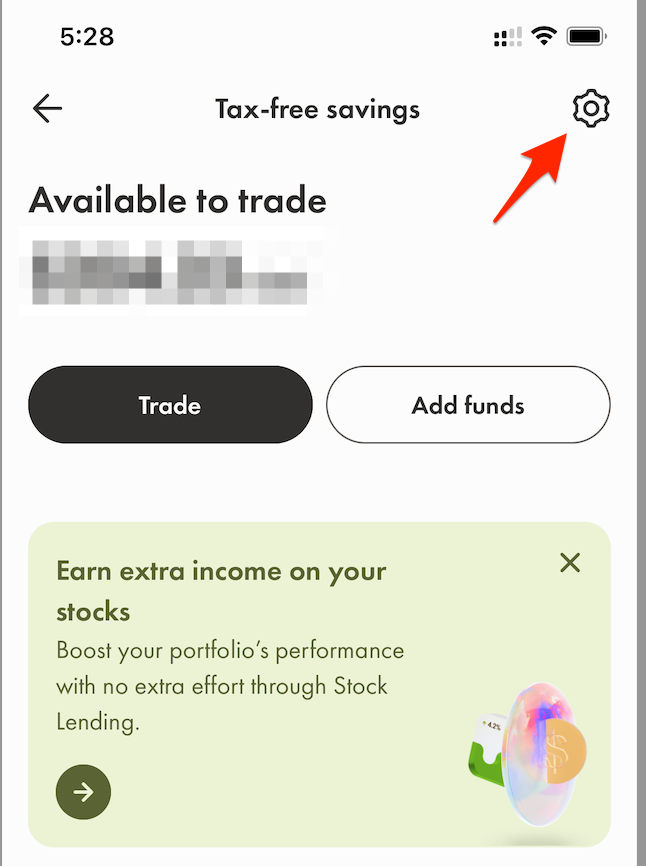

To set up Auto Dividend Reinvestments, go to your account settings.

Just leave this option on!

Most media reports that a real recession is coming this year.

“You guys made a fuss about a recession coming in 2023!!!”

So I decided not to believe the media’s predictions and I have still 7 stocks and 3 bonds or HISA ETFs.

If there is a real recession and stocks fall, I plan to sell my bonds and HISA and slowly switch to stocks.

So far, the performance of HXQ and VFV, which I bought while consolidating everything last year, has been good. + 4.4% and + 2.8%, respectively.

Current ETF holdings

- HSAV.TO – Cash ETF

- HXQ.TO – NASDAQ 100 ETF (+ 4.4%)

- VFV.TO – S&P 500 ETF (+ 2.8%)

- VLB.TO – Canada Long-Term Bond ETF (+ 1.84%)

To create an account with Wealthsimple, use the link below to receive a referral bonus.

Download the Wealthsimple appScan the QR code above to open and fund an account, and get rewarded.

If you did not enter the referral code when creating an account, enter the FLPEQG code directly and receive $25.